Do you have nightmares about the IRS?

Have you omitted to file annual US tax returns?

Have you failed to notify the IRS about your foreign bank accounts?

You are not alone. Many expats make these and other related errors in their dealings with the Internal Revenue Service (IRS).

There is a way out, a way to avoid all penalties. The IRS has Streamlined Foreign Offshore Procedures designed to help US citizens living abroad who have unknowingly become delinquent in their dealings with the IRS.

What Are Your IRS Obligations as an Ex-Pat?

You must fill in Form 1040 (annual tax return) every year regardless of where you live.

On your Form 1040, you must notify the IRS of any foreign income from employment, self-employment, or other sources such as shares or partnerships. You must use Form FBAR to tell the US Treasury Department of any foreign bank accounts in which you have an interest, including, business and personal accounts with traditional or online banks and joint accounts.

You will be paying tax to the foreign tax authority, and usually, this will count as a deduction against any US tax due. However, even if you are certain you owe no US taxes you must still fill in an annual IRS tax return and foreign bank declaration form. The only way out is to renounce your US citizenship: do you really want to do that when it won’t even get you off the hook for your past non-filings.

What Are the Streamlined Procedures?

The streamlined procedures are one of the systems the IRS has to encourage ex-pats to meet their US taxation obligations, even if they have let things slip for years.

Under these procedures, US citizens have a once-off opportunity to ask for a tax amnesty.

Applicants will need to supply details of their foreign income for the past three years and provide details of foreign bank accounts they have held for the previous six years. These limits apply regardless of the number of years you have failed to file Form 1040 (annual tax return) and offer expats who have not filed Form 1040 for decades an extremely beneficial route to IRS tax compliance again.

What about IRS Late Filing Penalties?

You will escape all late filing penalties, but will still have to pay any tax you owe, with interest.

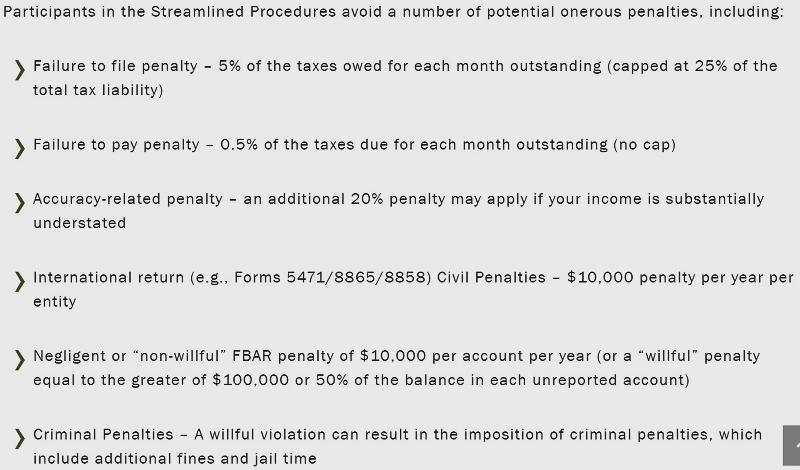

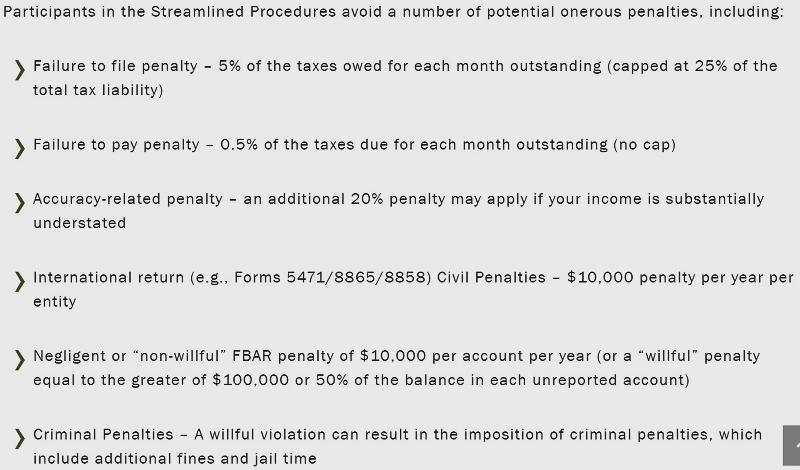

Late filing penalties mount up quickly and can amount to far more than any tax owed:

Expat tax specialists, ExpatTaxProfessionals.com have compiled the list of potential penalties you can avoid below:

By going through the IRS-sanctioned streamlined procedures, you only have to pay the tax you owe over the past three years, even if you have failed to file thirty-three years of returns.

Are You Eligible?

As long as you are an individual who has not previouslyused the streamlined procedures then you are eligible. Similarly, you can apply if you are administering an individual’s estate. You must also be able to explain how you became delinquent because individuals who have wilfully remiss in their filings are not eligible for the streamlined procedures.

You will send Form 14653 with your application to be considered under the streamlined procedures. On this form, you will need to give your full financial story including how and why you opened your foreign bank accounts, reasons for deposits and withdrawals, and an explanation regarding the source of any amounts in your bank accounts.

The IRS wants you on board, so they will not be overly aggressive and will listen to reasonable explanations.

If you are eligible, you should apply sooner rather than later because this tax amnesty route will not be available indefinitely.

Double Taxation Agreements

The US has double taxation agreements with many countries and if you are resident in such a country then any income tax you pay there will reduce your US income tax by the same amount. Send Form 1116 with your application.

You may be able to use the Foreign Earned Income Exclusion to further reduce your US tax liability. Your housing rental costs abroad will also reduce your US federal taxes. Send Form 2555 with your application.

The Short Version

The IRS wants you to become compliant. The Streamlined Procedures allow you to catch up with your US tax affairs without paying thousands of dollars in penalties, though you will have to pay any tax that you owe.

If you were considering giving up your US citizenship to avoid dealing with the IRS, you now have an alternative that will cost you less while not taking away your right to live and work in your home country.